Checking ACCOUNTS

ONLINE CHECKING ACCOUNT

First Oklahoma Bank’s online checking account lets you earn a competitive interest rate from anywhere. Enjoy the convenience of managing transactions 24/7 whether you’re at home, work, or on the go!

Sign up in minutes right from your phone and enjoy the flexibility and earnings of our High Yield Online Checking Account.

High Yield Online Checking Account Details:

- 3.50% APY (Annual Percentage Yield). Rate may change after account is opened. Fees may reduce earnings

- Get started with a $50.00 opening deposit. After that, no minimum balance required

- Free debit card

- No service charge with electronic statements. Or get paper statements for $5 a month

- Mobile deposit

- Bill pay

- Manage transactions 24/7 online and through the mobile app

- Refunds on ATM fees, up to $25 a month. Exclusions apply

- Surcharges waived at Oklahoma QuikTrip ATMs

Basic Checking

Choose our everyday checking account for a reliable and hassle-free banking experience that fits your daily lifestyle.

Basic Checking Account Details:

- Get started with a $50.00 opening deposit. After that, no minimum balance required

- Free debit card

- No service charge

- Mobile deposit

- Bill pay

- Manage transactions 24/7 online and through the mobile app

- Refunds on ATM fees, up to $25 a month. Exclusions apply

- Surcharges waived at Oklahoma QuikTrip ATMs

INTEREST CHECKING

Enjoy the convenience and flexibility of a traditional checking account while earning a competitive interest rate on your deposited funds. By maintaining a higher balance in your account, you’ll watch your money grow over time, providing an added bonus to your everyday banking activities.

Interest Checking Account Details:

- Two free boxes of checks per year

- Free debit card

- Free safe deposit box, if available

- Interest paid on balance tiers. Click here for current rates

- Mobile deposit

- Bill pay

- Manage transactions 24/7 online and through the mobile app

- Refunds on ATM fees, up to $25 a month. Exclusions apply

- Surcharges waived at Oklahoma QuikTrip ATMs

- Avoid $15 service charge by keeping balance above $2,000 or total combined account balance above $15,000

Access Your Money Anytime, Anywhere

The choice is yours!

First Oklahoma Bank provides several convenient ways for you to access your money from your checking account.

- Mobile app

- Online banking

- Debit card

- Checks

- ATM

- Mobile wallet

- Bank lobby

- Drive-thru

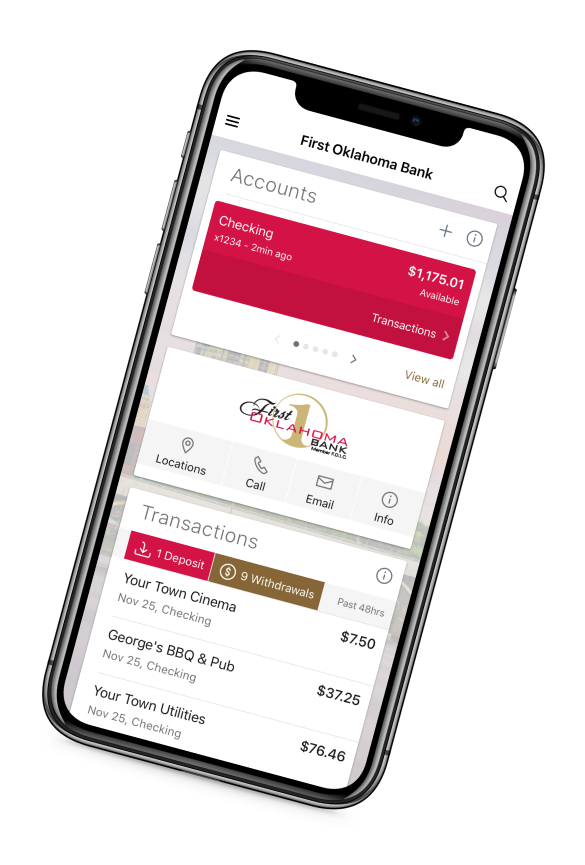

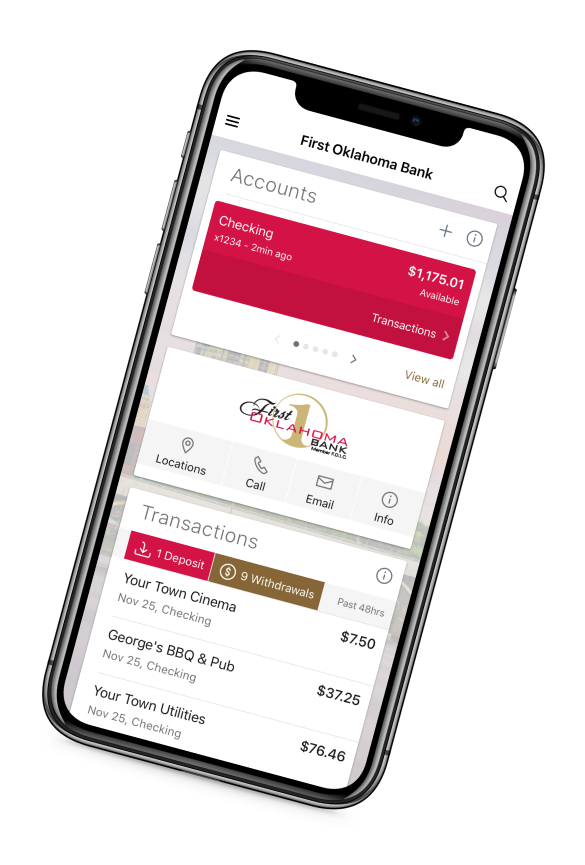

Download the First Oklahoma Mobile App

Manage your finances on the go with our user-friendly mobile app. You can check your account balance, transfer funds, pay bills, and even deposit checks using your smartphone. Enjoy the convenience and peace of mind knowing that your money is just a few clicks away.

FAQS

How do I open a checking account?

You can start a checking account with a $50 opening deposit. You’ll also need a valid ID such as a driver’s license or other government issued ID and your social security number.

When will I receive my debit card?

You’ll receive your debit card automatically within 7-10 days after opening your account.

How do I request paper checks?.

- Log in to your account online or through the First Oklahoma mobile app.

- Select the account you want to write checks from and click “Reorder Checks”.

How do I access my account online?

- Download the First Oklahoma Bank mobile app or visit https://my.firstoklahomabank.com/login.

- Click “First time here? Enroll now.”

- Enter your Social Security number, account number, email, and the phone number you provided at account opening.

- Once you click Next, a verification code will be sent to the mobile phone number you provided and/or the Authy app if you already have it installed.

- Enter the verification code and then choose your username and password. Now you can begin banking anytime, anywhere!

How do I sign up for eStatements?

- Login to your account online or through the First Oklahoma mobile app.

- Click “Document Management”.

- Choose “Sign Up/Changes” and select the accounts to enroll for electronic delivery.

HOURS & LOCATIONS

Jenks Branch

100 S Riverfront Dr

Jenks, OK 74037

Lobby Hours:

Monday – Friday | 9:00 a.m. – 5:00 p.m.

Drive-thru Hours:

Monday – Friday | 8:00 a.m. – 6:00 p.m.

Saturday | 8:00 a.m. – 12:00 p.m.

ATM:

Available All day

Glencoe Branch

311 W Main St

Glencoe, OK 74032

Lobby Hours:

Monday – Thursday | 9:00 a.m. – 3:00 p.m.

Friday | 9:00 a.m. – 4:30 p.m.

Midtown Branch

4110 S Rockford Ave

Tulsa, OK 74105

Lobby Hours:

Monday – Friday | 9:00 a.m. – 5:00 p.m.

Drive-thru Hours:

Monday – Friday | 8:00 a.m. – 6:00 p.m.

Saturday | Closed

ATM:

Available All day

Loan Production Office

1801 Wheeler Street

Oklahoma City, OK 73108

Lobby Hours:

Monday – Friday | 9:00 a.m. – 5:00 p.m.